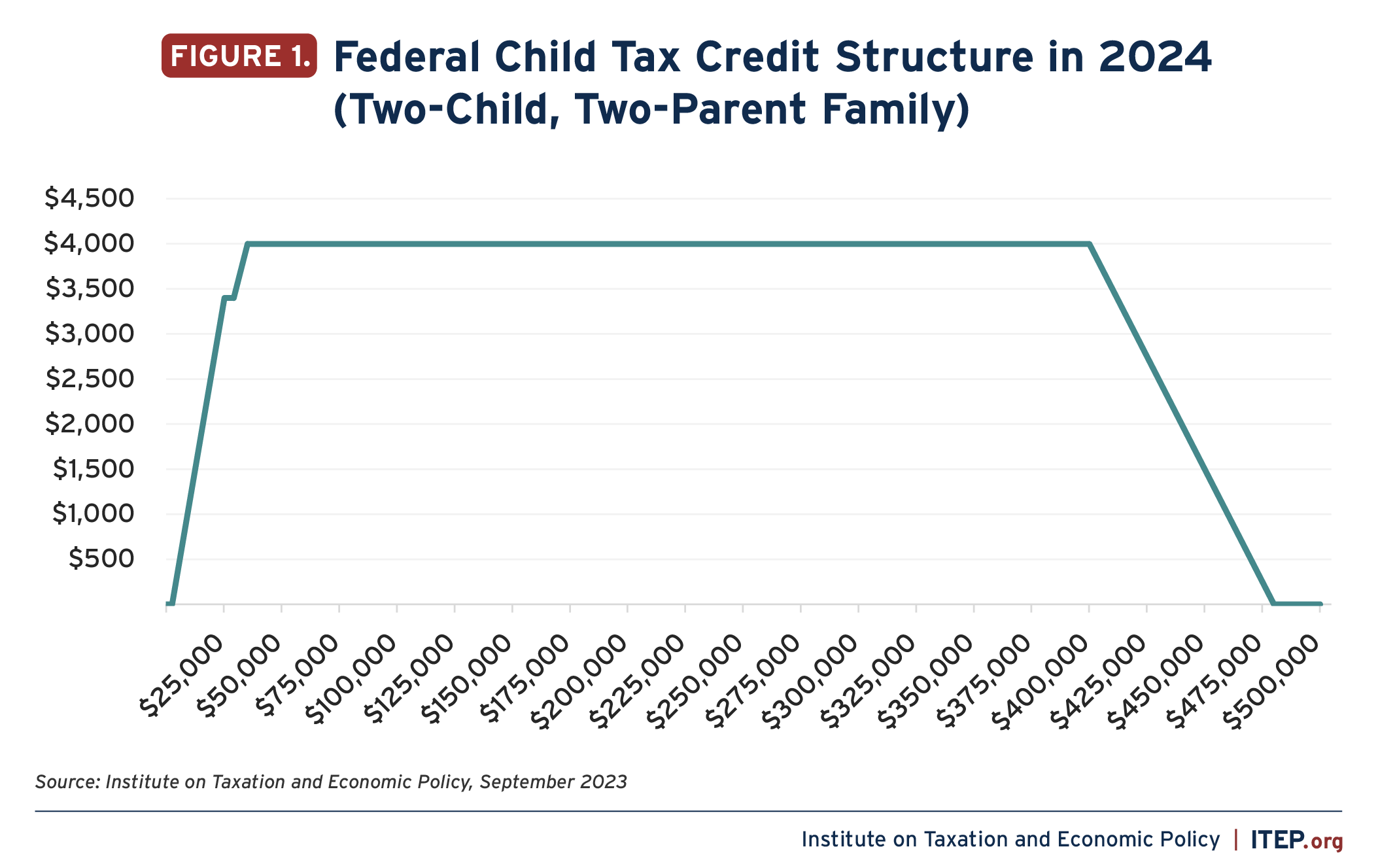

Child Tax Credit 2024 Phase Out

Child Tax Credit 2024 Phase Out – “Federal student loan borrowers who were required to continue student loan payments starting in the fall of 2023 could qualify to deduct up to $2,500 of student loan interest per tax return per tax . The 2024 tax season is starting soon, and you may be looking for all the tax credits you’re eligible for. If you have kids, you probably already know whether you’re eligible for the federal child tax .

Child Tax Credit 2024 Phase Out

Source : itep.org

The American Families Plan: Too many tax credits for children

Source : www.brookings.edu

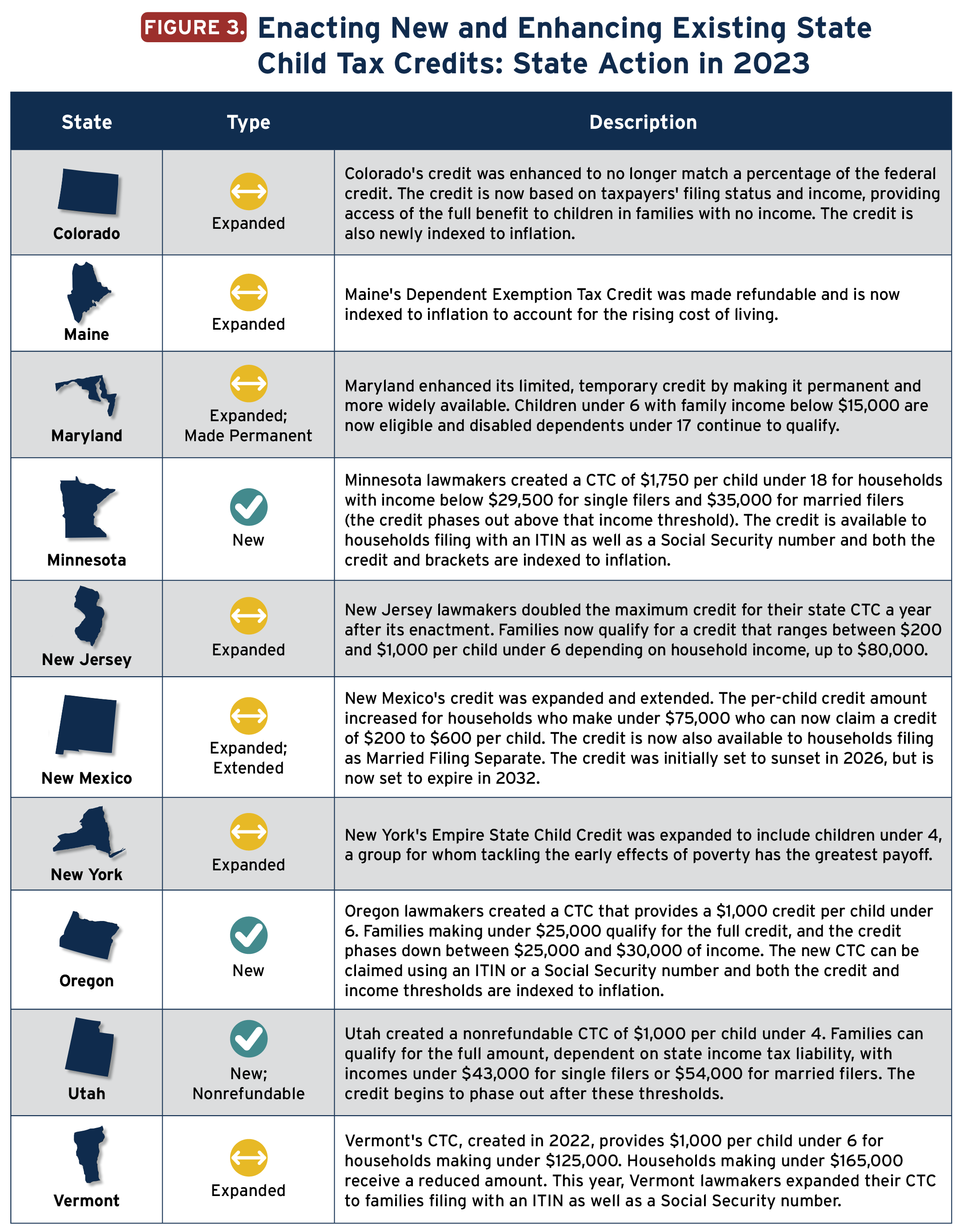

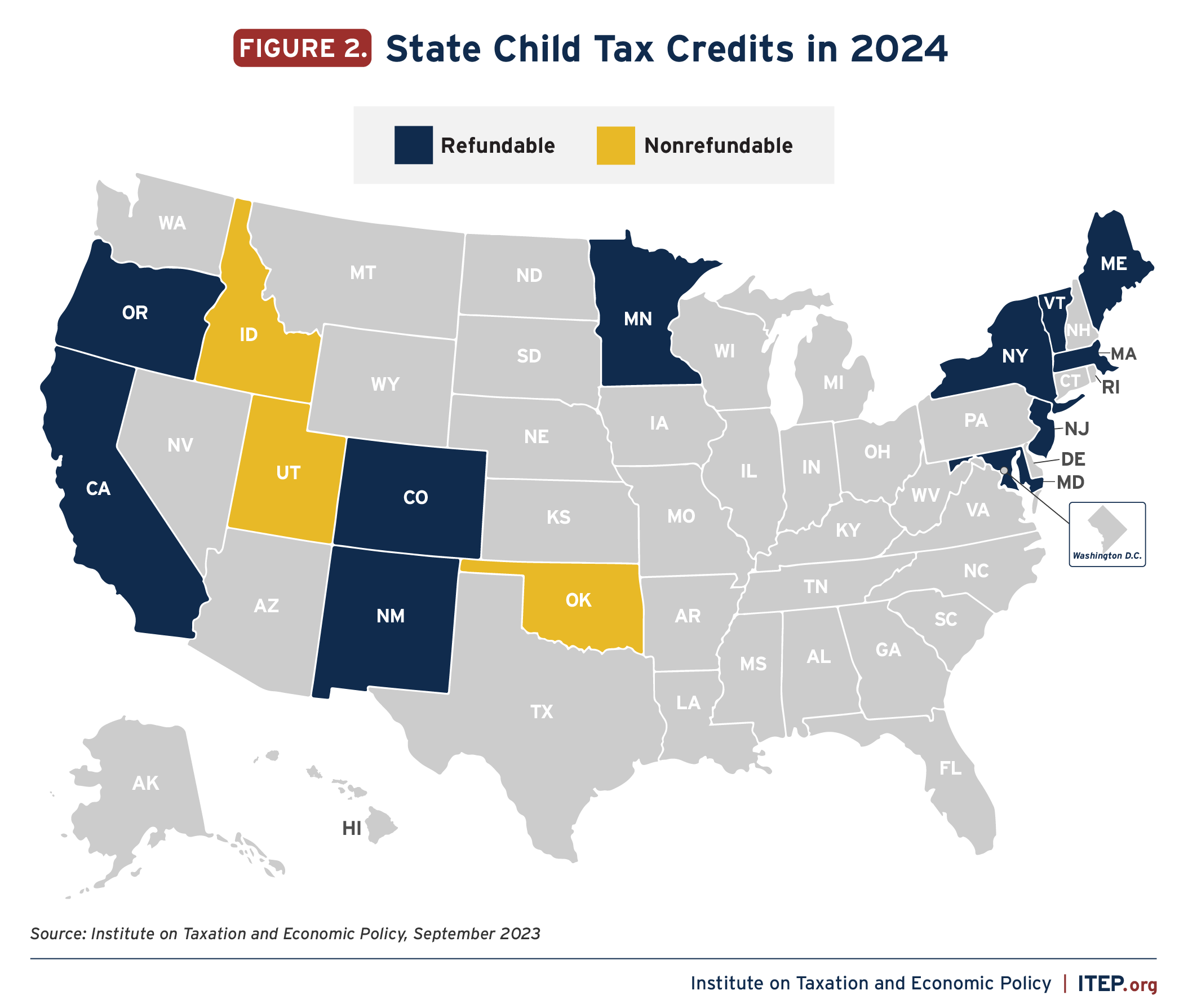

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

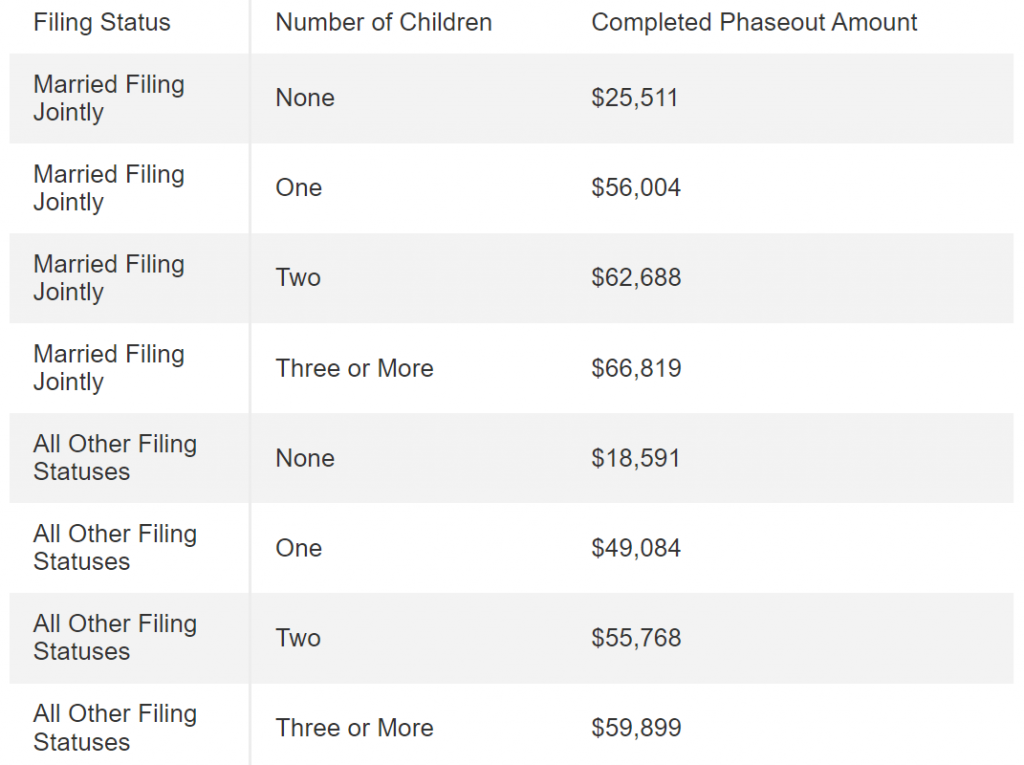

Here Are the 2024 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.com

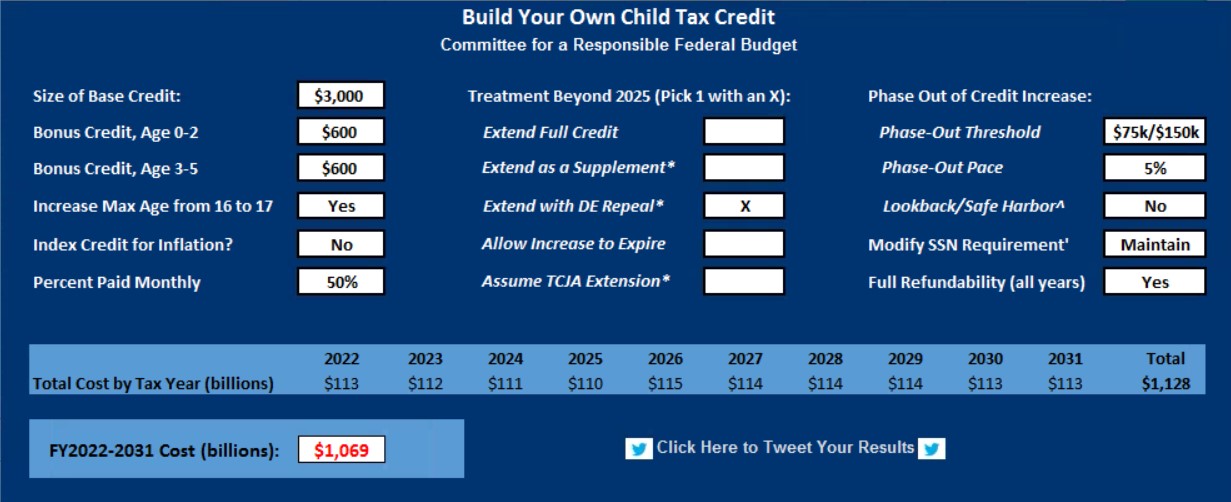

Build Your Own Child Tax Credit 2.0 | Committee for a Responsible

Source : www.crfb.org

2023 and 2024 Child Tax Credit: Top 7 Requirements TurboTax Tax

Source : turbotax.intuit.com

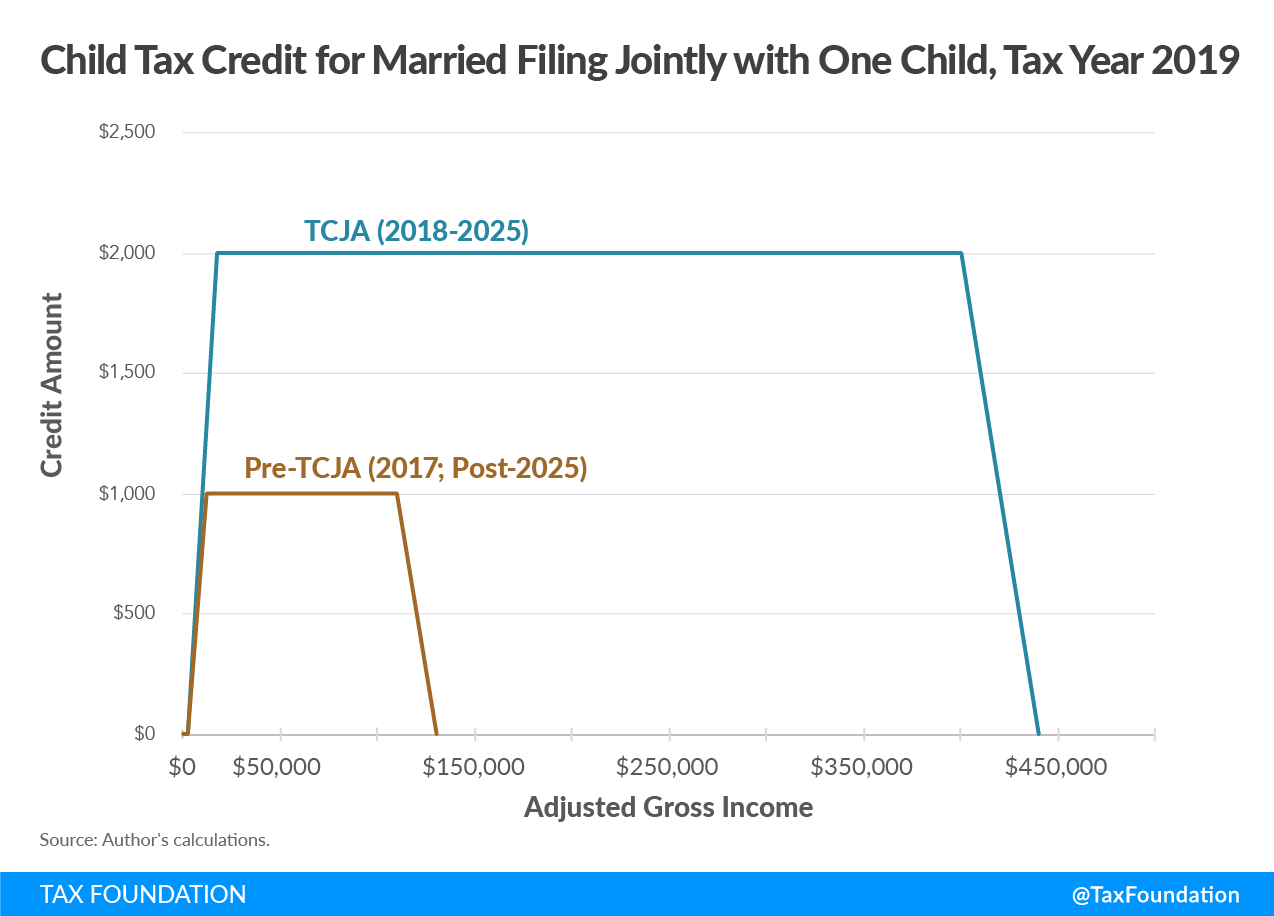

Child Tax Credit Definition | TaxEDU | Tax Foundation

Source : taxfoundation.org

States are Boosting Economic Security with Child Tax Credits in

Source : itep.org

Child Tax Credit 2023 2024: Requirements, How to Claim NerdWallet

Source : www.nerdwallet.com

Here Are the 2024 Amounts for Three Family Tax Credits CPA

Source : www.cpapracticeadvisor.com

Child Tax Credit 2024 Phase Out States are Boosting Economic Security with Child Tax Credits in : While parents may be shelling out thousands of dollars a month for child care costs alone, they can offset these expenses with two tax credits this season. . Paying firms for decisions they made years ago does little more than provide a financial windfall for shareholders of the firms that take advantage of the tax reductions .