Tax Relief For American Families And Workers Act Of 2024 Law

Tax Relief For American Families And Workers Act Of 2024 Law – The Tax Relief for American Families and Workers Act of 2024 (H.R. 7024) would terminate the employee retention credit (ERC) for claims filed after January 31, 2024. Initially authorized by the CARES . The House Ways and Means Committee Jan. 19 voted 40-3 to advance the Tax Relief for American Families and Workers Act of 2024. .

Tax Relief For American Families And Workers Act Of 2024 Law

Source : www.wolterskluwer.com

Tax Relief for American Families and Workers Act of 2024

Source : tax.thomsonreuters.com

T24 0012 — Tax Units with a Tax Increase or Tax Cut from The Tax

Source : www.taxpolicycenter.org

What They Are Saying: Tax Relief for American Families and Workers

Source : waysandmeans.house.gov

T24 0010 — Tax Units with a Tax Increase or Tax Cut from The Tax

Source : www.taxpolicycenter.org

The Tax Relief for American Families and Workers Act of 2024

Source : www.finance.senate.gov

What They Are Saying: Tax Relief for American Families and Workers

Source : waysandmeans.house.gov

PKF O’Connor Davies | Harrison NY

Source : m.facebook.com

T24 0009 — Tax Units with a Tax Increase or Tax Cut from The Tax

Source : www.taxpolicycenter.org

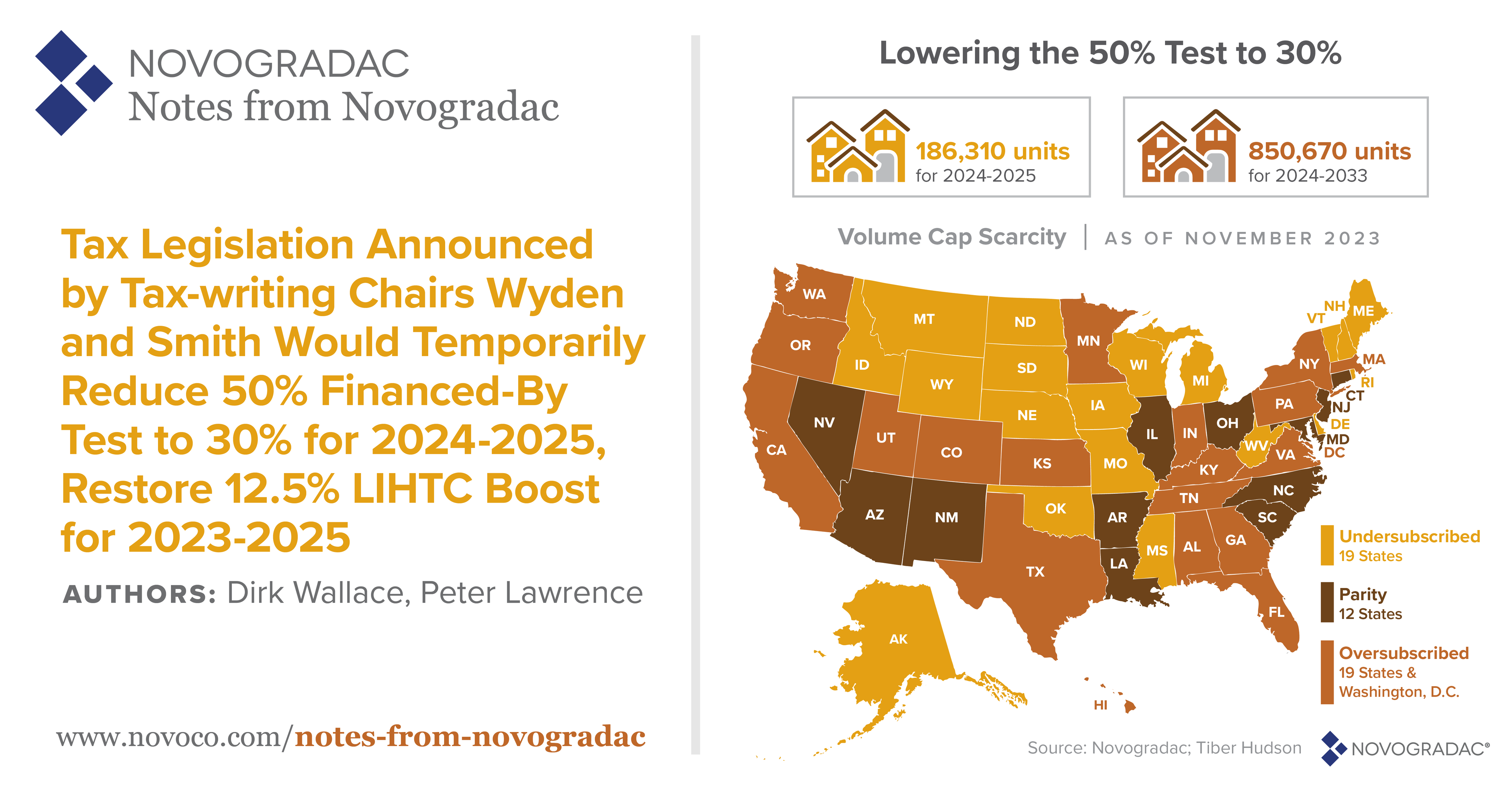

Michael Novogradac (@Novogradac) / X

Source : twitter.com

Tax Relief For American Families And Workers Act Of 2024 Law The Tax Relief for American Families and Workers Act of 2024 : Low-income parents stand to benefit the most from proposed Child Tax Credit increases for the 2023 tax season — and their savings could add up to thousands depending on how . And not limited solely to its earlier definition, “tax relief” can also include assistance provided by IRS programs designed with debt settlement purposes specifically intended for Americans .